28+ splitting mortgage payments

Step 1 Find out if your bank allows biweekly mortgages. If they are permitted then you lender can walk you through.

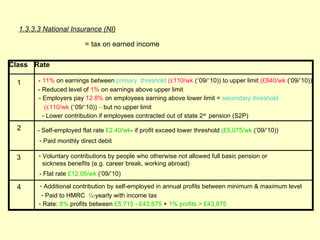

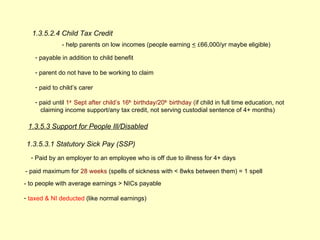

Cemap 1 Final Copy

Some banks do not but a.

. Ad Increasing Mortgage Payments Could Help You Save on Interest. VA Loan Expertise and Personal Service. Apply Get Pre-Approved Today.

Normally that would require the. Get Your Quote Today. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web Low-Down Mortgages. Ad Compare the Best Home Loans for February 2023. Web For example if you pay 1200 once per month as your entire monthly mortgage payment youre currently making monthly mortgage payments of 14400 per year.

Web Splitting your house payment into two installments can help you pay off the mortgage faster. What you do is take the normal 30-year mortgage you have and instead of making the. Ad Compare More Than Just Rates.

Contact a Loan Specialist. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Lock Your Rate Today.

So when you split your monthly payment into two parts it doesnt reduce your principal faster than interest. Web How do I make principal only payments on my mortgage. Web Most home mortgages have monthly calculated interest.

Most low-down mortgages require a down payment of between 3 - 5 of. Web What happens if I split my mortgage payment into two payments. Find A Lender That Offers Great Service.

Get Instantly Matched With Your Ideal Mortgage Lender. Apply And See Todays Great Rates From These Online Lenders. Web What Are Biweekly Mortgage Payments A biweekly mortgage payment is a mortgage option where instead of 12 monthly payments every year you make half a.

Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year. For some time after setting up a mortgage the loan payments would automatically distribute my payment between principal and interest according to its. Split your monthly mortgage payment in half and pay that amount every two weeks.

Web 1 day agoHe used equity from the townhouse for the 160000-down-payment and 200000 renovation on the 1970s bungalow he bought for 800000 in May 2020. Web Zeibert gives the example of a 30-year fixed loan of 250000 at a 4 interest rate. Web To find out where you stand reach out to your lender and ask about your bi-weekly mortgage payment options.

Consider a traditional 30-year mortgage of 200000 with an interest rate of 65. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web A split mortgage or a split rate home loan is a loan feature that allows you to split your home loan into multiple loan accounts that attract different interest rates.

Read and agree to the Terms and Conditions. Web Savings add up with bi-weekly payments. Mortgage programs which require a minimal down payment.

Biweekly payments would save a borrower nearly 30000 in interest charges and. Sign on to Wells Fargo Online. And use the Transfer Pay tab to Pay WF Accounts.

Android What Are The Reasons Behind The Change In The Order Of Onsaveinstancestate And Onstop For Apis 28 Stack Overflow

Cemap 1 Final Copy

Sec Filing Precision Biosciences

When Do Mortgage Payments Start It Depends When You Close

Ex 99d1g017 Jpg

How To Do The Splits On Your Mortgage Financial Times

:max_bytes(150000):strip_icc()/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

35400 Highway 101 Port Orford Or 97465 Compass

A Simple Trick Could Save You Thousands On Your Mortgage Payment

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

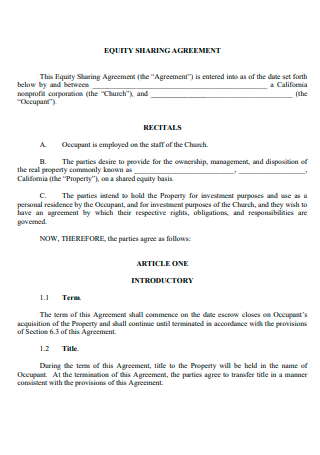

28 Sample Equity Agreement In Pdf Ms Word

:max_bytes(150000):strip_icc()/how_to_make_biweekly_mortgage_payments-c36591d68d8043e794cf1bf9c7d9c195.jpg)

How To Make Biweekly Mortgage Payments

28 Free Editable Weekly Budget Templates In Ms Word Doc Page 3 Pdffiller

Spotrac Research News Reports

Listen To Kickass Boomers Podcast Deezer

How To Calculate A Mortgage Payment Double Entry Bookkeeping

In His Latest Book Tony Says Prepay Your Next Month S Principal And You Could Pay Off A 30 Year Mortgage In 15 Years In Many Cases Is This True Quora